MFN is Coming. IRA is Here. Growth through Pricing is Dead.

With the MFN rule looming and the IRA already reshaping the landscape, pharma's most reliable growth lever, US pricing power, is structurally exposed.

Prescription drug prices in the US are 4.22 times higher than 33 peer high-income countries. Even after rebates, net prices are three times higher.

But that pricing buffer is about to evaporate.

With the Most Favored Nation (MFN) rule looming and the Inflation Reduction Act (IRA) already reshaping the landscape, pharma's most reliable growth lever, US pricing power, is structurally exposed.

It isn't just policy reform. It's an existential challenge to operating models built on premium pricing, cross-subsidized pipelines, and long-cycle R&D.

What will this mean?

Massive disruption and an even bigger opportunity for the bold.

How?

1. Shrinking Margins = Urgent Operational Discipline

For years, pricing masked inefficiencies. That era is over.

With IRA and MFN compressing margins, companies can no longer afford bloated pipelines, duplicated functional structures, or launch planning guesswork.

Operational excellence is no longer optional, it's a survival strategy.

2. From Pilot Projects to Enterprise Transformation

Pharma has spent years piloting AI and digital tools, yet individual contributors continue living in spreadsheets, slide decks, and emails.

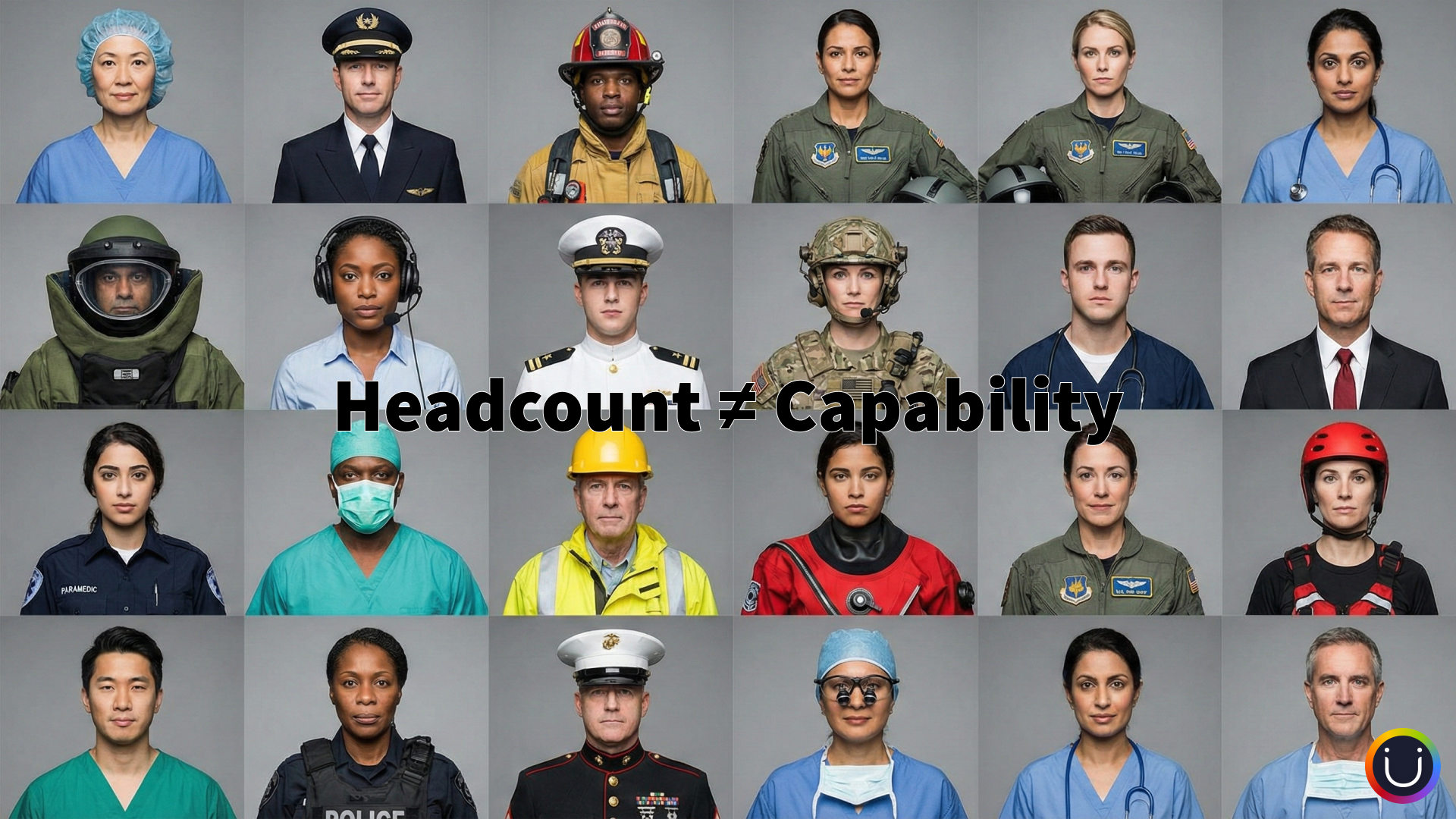

The next era will belong to companies that go beyond surface-level "transformation" and put power in the hands of the people doing the work, your biggest cost driver and your greatest source of efficiency.

Fancy-titled "transformation" initiatives with no real, lasting changes to widespread inefficient ways of working can no longer hide or be brushed under the rug due to the annual pricing increase levers.

Transformation is no longer "innovation theater." It must be the core of modern pharma operations driving:

- Unified orchestration across execution teams

- Cross-functional resource visibility

- Real-time scenario adaptation

Being a fast follower used to be a smart strategy, letting someone else take the risk. But when everyone's following... who's leading? If no one is leading, the industry operations will remain unchanged as they have been for the last three decades.

3. Global Market Access = Local Execution Agility

It's not just the UK's NICE anymore. Global pricing pressure is real and intensifying from Germany's AMNOG to China's NRDL and Canada's PMPRB.

To thrive globally, pharma needs:

- Digitally connected, region-aware, locally agile launch teams focused on minimizing off-revenue days for approved products.

- Rapid-response frameworks that adapt to shifting HTA expectations and reimbursement hurdles in real time.

Soon, when every day of lost revenue worldwide truly begins to hurt, leaders will need seamlessly coordinated global-scale operations with local execution precision.

4. R&D: Leaner, Sharper, Faster

Capital efficiency must join clinical brilliance as an R&D priority.

The truth is, all the efforts to bolster the preclinical pipeline with new targets, modalities, and candidates mean nothing if the operational pathway to IND, NDA, and commercially successful global launches continues to be riddled with inefficiency sinkholes.

What does that mean?

- Strategically go deep into rare diseases to leverage conditional approvals and expand the total addressable market over time.

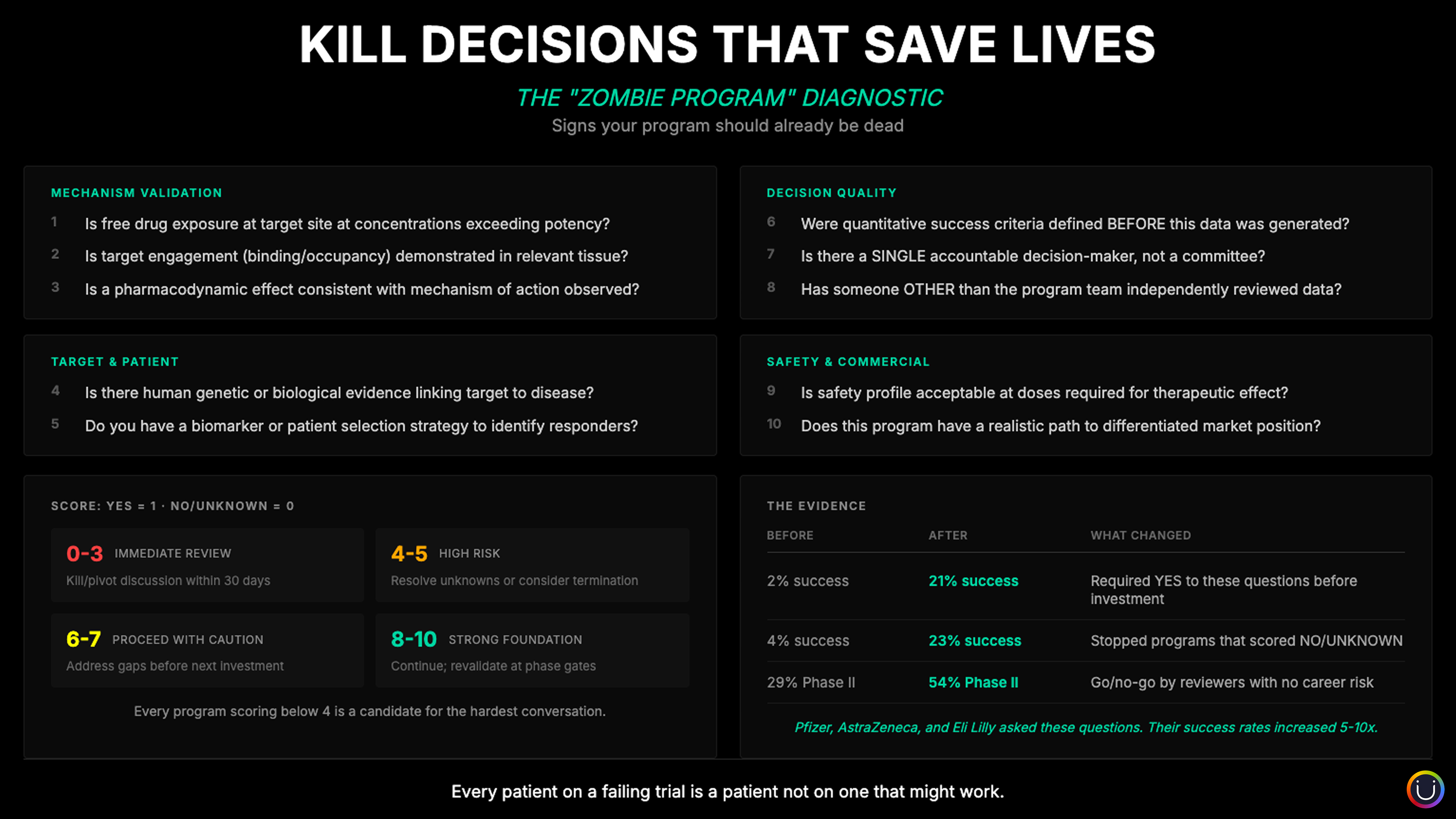

- Kill non-viable programs early. Sexy science alone doesn't move the needle for multibillion-dollar market caps.

- Prioritize assets based on value-based pricing potential, not just molecular promise.

- Use digital twin and adaptive trials to reduce cycle time and risk.

5. AI & Automation: From Experiment to Infrastructure

AI is no longer a curiosity. It's going to be the digital nervous system of next-generation pharma.

Think:

- AI-powered coordinated execution across functions with no room for handoff failures.

- Agentic AI for automating repetitive workflows, allowing Human Intelligence to focus on strategic thinking, creative execution, and high-leverage decisions.

- Live portfolio optimization engines that synthesize signals from clinical outcomes, HTAs, competitive intelligence, and market access realities.

Stop using humans as slide deck or spreadsheet jockeys. That's what machines are for.

Bottom Line

Pricing reform is the catalyst. Operational transformation is the mandate.

The question isn't whether pharma must change, it's how fast your organization can realign.

CXOs who realign early around access timelines, digital fluency, and cross-functional precision won't just survive the coming storm...

They'll define what pharma looks like on the other side.

Compliance

Unipr is built on trust, privacy, and enterprise-grade compliance. We never train our models on your data.

Start Building Today

Log in or create a free account to scope, build, map, compare, and enrich your projects with Planner.